Democrat May-June 2010 (Number 118)

Report by Brian Denny

Bailing out the banks

The European Union‘s 350 billion euro ‘rescue’ package for Greece offered in exchange for devastating austerity measures was not a bail out for the Greek people, it was a bail out for German and French banks, according to former Bundesbank head Dr Karl Otto Pöhl.

The so-called EU bail out was triggered when Greece faced economic meltdown after its sovereign debt was downgraded to ‘junk’ status.

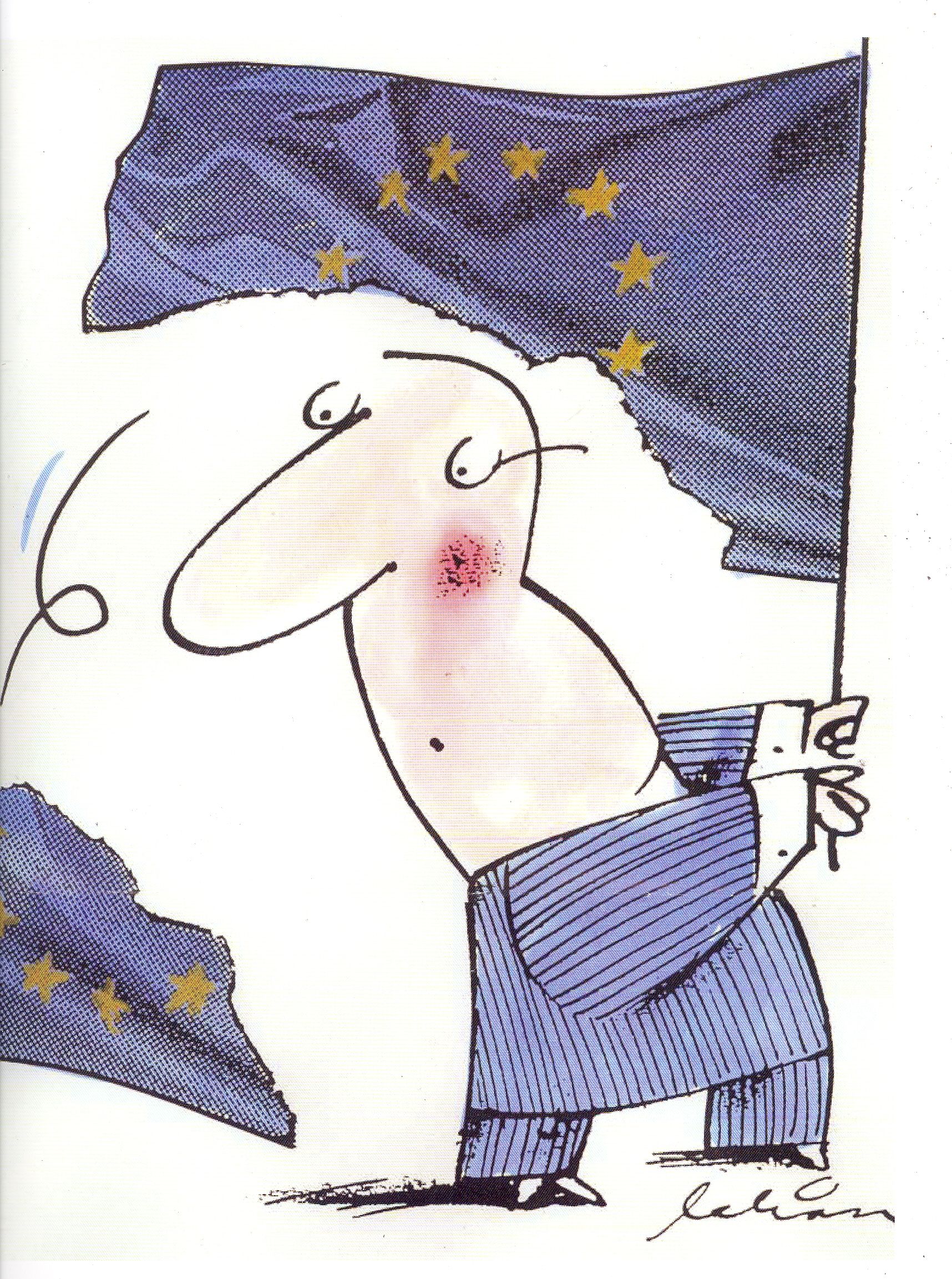

Poster by - Swedish Peoples Movement

Far from helping the ‘feckless’ Greeks, as claimed by much of the media, Dr Pöhl declared in Spiegel magazine that, in fact, the bail out was about protecting German and French banks from debt write-offs.

“On the day that the rescue package was agreed, shares of French banks rose by up to 24 percent. Looking at that, you can see what this was really about - namely, rescuing the banks and the rich Greeks,” he said.

The Greeks are actually the victims of the politics of ‘rescuing the European currency’ – by any means necessary. Spain and Portugal could share the same euro austerity treatment as they face the same debt crisis.

To meet EU austerity demands, the Greek government has proposed spending cuts of £26 billion, threatening all public services and sparking protests and general strikes.

The Greek Federation of Railway Workers national secretary Panayotis Latropoulos said that the government was hurriedly privatising the rail network in line with EU directives.

“They are trying to privatise our railways and destroy everything that has been built in the last hundred years,” he said.

Greek seafarers unions are also locked in a battle with the government over wide scale social dumping in Greece’s large maritime sector and the right to strike.

Powerful ship owners are cutting jobs, training and pension contributions while bringing in non-unionised exploited foreign labour. The government is also handing them huge subsidies by cancelling debts, offering cheap fuel and other handouts.

Government-backed courts attempted to ban strike action launched in protest at the cuts. Seafarers unions in the PAME federation took strike action anyway in protest and demanded a maritime policy based on people’s needs, the nationalisation of the shipping industry and for workers’ rights to be enshrined in law.

Problems in Greece began when it joined the European single currency, which demands a budget deficit of no more than three per cent of gross domestic product as laid out in the draconian EU Maastricht treaty.

Inside the eurozone is rather like a pressure cooker with no safety valve. Greece can no longer devalue its currency. Like other struggling eurozone countries, she can only slash public spending and raise taxation, sending the economy into further crises.

Greece no longer has democratic control over interest and exchange rates, these are set by the European Central Bank. But these crucial economic decisions are made to suit the needs of ‘core’ EU states such as France and Germany and not ‘periphery’ states like Greece, Portugal, Spain, Ireland and others.

As a result, Athens now owes French banks around £70 billion and German banks around £40 billion and any bail-out will be used to pay off these debts rather than defending public services. The EU is simply protecting Europe’s largest banks while demanding ever more austerity to suit the needs of the big states and their business backers.

Last year Baltic state Latvia carried out cuts as demanded by EU rules, resulting in a 30 per cent cut in public sector jobs and the remaining workers received a 25 per cent pay cut. More recently, the Spanish prime minister, Jose Luis Rodriguez Zapatero, recently announced a five per cent cut to public sector salaries, this is the EU social and economic model laid bare.

EU finance ministers have also agreed a rescue package worth £700 billion and a stability fund of government-backed loan guarantees and bilateral loans provided by eurozone members.

The allegedly legal basis for the stability fund is Article 122 of the Lisbon Treaty, which allows money to be sent to countries in the event of a natural disaster or other "exceptional event" beyond its control.

The European Council had previously claimed that the use of Article 122 could not breach the EU Treaties now shredded 'no bail-out' rule. The European Central Bank also announced it would break its own rules and buy eurozone government debt. This is part of the political process of transferring budgetary powers from member states to unaccountable EU institutions by stealth.

However political unrest is growing. A protesting trade unionist in Athens, Giorgos Didimopoulos, recently summed up the mood: “We fought against The Persians at Marathon, the Germans during the Second World War and we will fight now because in reality foreign forces are in charge of us”. This is the reality of the suicidal neoliberalism written into all the EU treaties which, staggeringly, still enjoys the support of most ‘left’ parties in Europe.